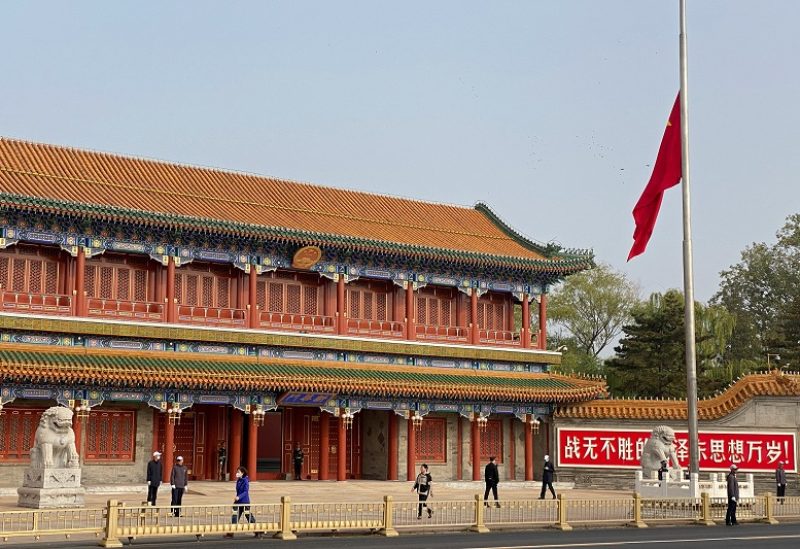

The Chinese flag at a gate to the Zhongnanhai leadership compound flies at half-mast in memory of late former Chinese premier Li Keqiang, in Beijing, China November 2, 2023. REUTERS/Mark Chisholm

As November draws to a close, signs indicate that China’s manufacturing activity might experience a second consecutive month of contraction, as per a Reuters poll. Forecasts suggest the official Purchasing Managers’ Index (PMI), projected to show a slight improvement to 49.7 from the previous month’s unexpected decline to 49.5. Despite this expected uptick, the index remains below the crucial 50-point mark that delineates contraction from expansion in manufacturing activities.

While some economists have observed green shoots in mixed October data, the consensus is that the economy is still grappling for traction, with predictions ranging between 49.0 and 50.2 and the majority anticipating a small contraction between 49.6 and 49.8.

The challenges facing China’s economy persist despite a series of policy support measures, including the struggle in the property market, risks associated with local government debt, slow global growth, and geopolitical tensions.

The inability to achieve a robust post-COVID recovery has intensified the call for additional stimulus. Profit growth at China’s industrial firms witnessed a slowdown, reverting to low single digits in the last month. Both new export and import orders contracted in October, underlining the headwinds faced by the manufacturing sector.

Analysts warn of a potential stagnation in China akin to Japan later this decade unless policymakers take decisive steps to reorient the economy toward household consumption and market-allocation of resources. While China’s central bank governor expressed confidence in the country’s healthy and sustainable growth in 2024 and beyond, he emphasised the need for structural reforms to reduce reliance on infrastructure and property for growth.

The government’s pursuit of an annual economic growth target of ‘around 5 per cent’ for next year may necessitate additional stimulus measures, aligning with the goals set for this year.

The official PMI, a crucial economic indicator, is set to be released on Thursday, providing further insights into the state of China’s manufacturing sector.

Concurrently, the private Caixin factory survey, scheduled for Friday, is anticipated to show a slight uptick to 49.8 from October’s 49.5. The outcome of these reports will likely influence policymakers’ decisions as they navigate the complex economic landscape and consider further measures to sustain growth and stability.